[Case 30] Navigating Finance in Later Life: Real-World Education through Public-Private Partnerships

Navigating Finance in Later Life:

Real-World Education through Public-Private Partnerships

Intro: Financial literacy matters to older adults

As digital and non-face-to-face transactions become the new norm, Korea’s financial environment is rapidly transitioning to an online-first model. While the digital transition has accelerated, older adults—still dependent on in-person banking—have found themselves at the margins of this new financial landscape. As traditional bank branches continue to close, many still struggle to navigate online and mobile platforms due to limited digital literacy. According to the Bank of Korea’s 2024 survey on payment methods and mobile finance usage trends, just 18.7% of adults aged 60 and over used mobile financial services—compared to 52.4% across all age groups.

The digital divide is only part of the problem. Older adults are disproportionately vulnerable to financial exploitation, sometimes even by family or caregivers, and remain frequent targets of fraud schemes like voice phishing. These overlapping challenges highlight the urgent need for practical, targeted financial education that reflects the realities older Koreans face.

Recognizing the rising risk of financial exclusion among older adults, both legacy financial institutions and newer fintech platforms are stepping up efforts to improve financial literacy and capability in later life. Banks, credit card companies, and credit cooperatives, as well as digital players like Kakaopay, are rolling out targeted education programs. These include digital finance courses and instructor training initiatives, some of which are implemented in collaboration with the Senior Financial Education Council (hereinafter “the Council”).

Established in 2018 as a non-profit organization, the Council focuses on strengthening older adults’ financial capabilities. It dispatches trained instructors to conduct sessions at senior welfare centers, public libraries, and other community venues frequented by older adults.

Key features of senior financial education: (1) Customized, practice-based learning

These programs typically cover practical, everyday topics such as mobile banking, digital wallets, and fraud prevention. Participants learn how to check account balances and pay utility bills using mobile apps, as well as how to recognize and respond to the latest financial scams. The programs are offered free of charge, funded through the ESG budgets of participating financial institutions.

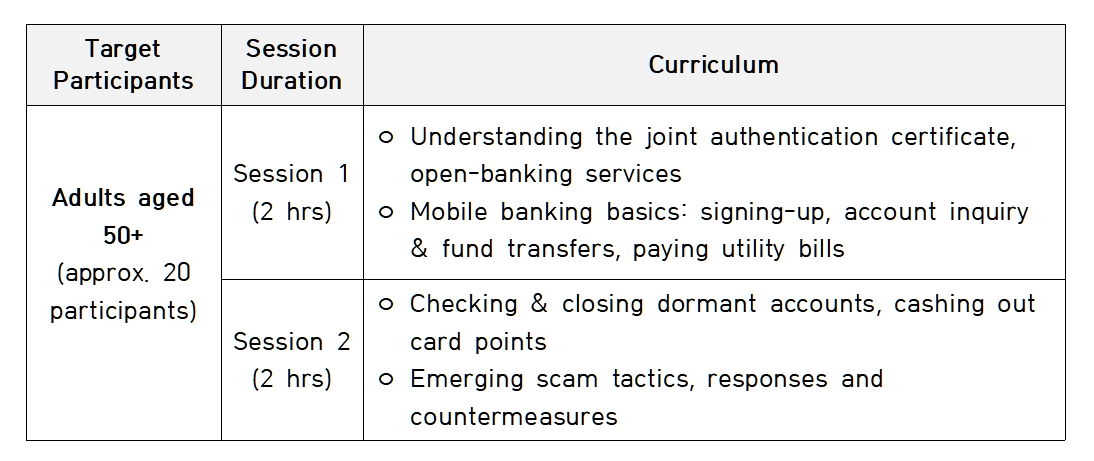

(Table 1) “Digital Finance Education for Seniors” held in September 2024 at Dongdaemun-gu Public Digital Library (Hosted by the Council, sponsored by KB Kookmin Bank)

These programs do more than just pass along information. Designed to build both financial competence and confidence, they emphasize hands-on practice over traditional lectures, enabling older adults to manage their finances independently.

To support more effective learning, providers incorporate a range of instructional tools—including small-group sessions, assistant instructors, and video-based reinforcement via QR codes. By adapting to individual learning speeds and practical needs, the sessions allow participants to follow along comfortably, from installing banking apps to completing money transfers, using mobile banking services, and making digital payments.

Older adults have responded positively to this learner-centered model. One participant in her sixties shared, “I live apart from my children, so I don’t have anyone I can easily ask,” adding, “I’ve been so satisfied with the class—I plan to attend every session until the end.”

<Photo 1>

A digital finance education session for seniors held at the Seoul Dobong Senior Welfare Center (Photo courtesy of Women’s Economic Daily)

Key features of senior financial education: (2) Peer-led model through senior instructor training

Another element that sets these programs apart is that older adults are not only learners—they also serve as instructors, taking on active roles in educating their peers. A prime example is Kakao Impact’s Senior Digital School project, one of its flagship social contribution initiatives. Operated in partnership with the Council and other supporting organizations, the project trains senior instructors aged 50 and older. These instructors are dispatched in teams of four to provide financial literacy sessions as lead educators or teaching assistants.

The curriculum covers a range of digital finance topics, including how to make payments and transfers using Kakaopay, manage assets, and prevent scams. It also includes practical digital skills such as using map services and mobile identification tools. As of 2025, the program operates at 50 senior-serving institutions nationwide, including senior welfare centers and job matching centers. Each facility receives customized course materials along with a KRW 500,000 (approx. USD 360, as of Aug. 25, 2025) grant to support operations.

These programs are noteworthy in that they offer older adults not only new avenues for social participation, but also opportunities for peer learning in the digital finance space. In this mutually beneficial setup, instructors gain a sense of purpose and fulfillment, while participants receive guidance that is accessible and attuned to their needs. Far from being one-off events, these programs contribute to building a peer-empowered, self-sustaining education ecosystem—one in which older adults take on active, meaningful roles.

<Photo 2>

A “Senior Digital School” session held at the Seoul Dongdaemun Senior Welfare Center

(Photo courtesy of Kakao Impact and JoongAng Ilbo)

Key features of senior financial education: (3) Creative approaches to preventing fraud

Meanwhile, theater has also emerged as an effective tool for guarding older adults against financial scams, with performances now being used to help audiences recognize various types of financial threats and respond appropriately.

One such initiative was presented under the title “Madang-geuk (a form of open-air Korean folk theater blending humor, music, and social commentary) for the Protection of Senior Financial Consumers: The Return of Chunhyang 2025.” Held in early 2025 at the Woori Mapo Senior Welfare Center in Seoul, the event was hosted by the Council and sponsored by IBK Industrial Bank of Korea.

The performance reimagined familiar characters from The Tale of Chunhyang—a classic Korean love story about a woman who remains loyal to her lover despite pressure from and imprisonment by a corrupt official—to deliver clear, relatable messages on emerging scams involving virtual assets, voice phishing, and smishing via text messages. Upbeat musical interludes helped sustain audience engagement, and the show concluded with a memorable call to action: the “Three-Step Rule”—Be Suspicious, Verify, and Disconnect.

Interactive, hands-on programs like this play a dual role: shielding older adults from fraud and equipping them to approach digital finance with greater confidence and autonomy.

<Photo 3>

Scene from a Financial Scam Awareness Performance at Woori Mapo Senior Welfare Center, Seoul (Source: Women’s Economic Daily)

In closing: Senior financial education as a matter of rights

As explored throughout this coverage, financial education for older adults goes beyond digital skill-building—it serves as a practical vehicle for safeguarding autonomy and, by extension, upholding dignity in later life. In today’s fast-changing financial landscape, courses that help older adults spot evolving scams and navigate new digital services are key to preventing exploitation and exclusion.

What laid the groundwork for senior financial education in Korea was the establishment of a legal and policy framework, marked most notably by the enactment of the Act on the Protection of Financial Consumers in 2021. The Act guarantees financial consumers the right to receive essential education to make informed decisions and designates the Financial Services Commission (FSC) as the principal agency responsible for delivering such education. Within this framework, the FSC is tasked with regularly assessing financial literacy across demographic groups—including older adults—and advancing policies to improve access and protect ageing consumers from financial harm. Progress seen in 2025 reflects close collaboration between stakeholders across both public and private sectors.

In super-aged societies, financial literacy is no longer optional. Equal access to financial services and information must not be contingent on age or digital proficiency. Financial and digital skills are now central to quality of life—especially in later years, which often entail an extended period of post-retirement self-reliance.

Against this backdrop, financial education programs for older adults—offered in partnership between financial institutions and the Council—are helping shift older adults from the sidelines of digital finance to active, informed participants. This progress is backed by strong institutional support, including ongoing policy efforts by the Financial Services Commission. To keep moving forward, continued commitment will be essential to expand these programs and cement them as a vital safeguard for older adults’ financial inclusion and autonomy.